Carbon intensity regulation to make or break global low-carbon hydrogen market

Blue and green hydrogen emissions

Exporters and developers need to consider full value chain

emissions associated with hydrogen, says new WoodMac report

BEIJING/LONDON/HOUSTON, 15 February 2024 – The future of low-carbon hydrogen hinges on global policymakers introducing regulations and subsidies that focus on the carbon intensity of the hydrogen produced rather than its colour, according to Wood Mackenzie’s Horizons report ‘Over the rainbow: Why understanding full value-chain carbon intensity is trumping the colour of hydrogen.’

“The push for better measurement of efforts to cut emissions globally is shining a spotlight on the precise carbon intensity of different sources of hydrogen supply. Because of its potential to deliver almost carbon-free hydrogen, green hydrogen is generating the most industry interest, but it is important exporters and developers look more closely at the full value chain as more regulation is put in place,” Flor De La Cruz, Principal Analyst, author of the report, said.

Carbon intensity of blue and green hydrogen

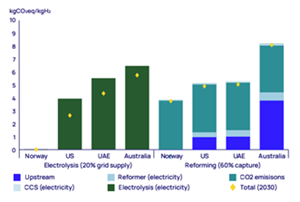

For green (electrolytic) hydrogen, nearly all emissions are attributable to the electricity used by the electrolyser. In principle, it should only be called ‘green’ if it uses 100% renewable power. However, the variability of renewables means that multiple electrolytic hydrogen projects are planning grid connection to maximise the utilisation of electrolysers and lower hydrogen unit costs. However, if the availability of renewable power is limited, there is a high risk that green hydrogen projects will need to connect to grids with very high carbon intensity, stated the report.

According to Wood Mackenzie’s hydrogen value chain emissions model, emissions from green hydrogen produced from 100% grid power could be as high as 50 kilograms of CO2 equivalent per kilogram of hydrogen (kgCO2e/kgH2) – worse than brown hydrogen* – if the electrolyser is connected to a grid powered by fossil fuels. Currently, at least 30% of the 565-gigawatt electrolysis (Gwe) of announced or operational green hydrogen projects are expected to be grid connected, as shown in Wood Mackenzie’s Lens Hydrogen project tracker.

In the case of blue hydrogen, emissions can come from upstream natural gas production, transportation, reforming, and energy use. In principle, almost all these emissions can be captured and stored. However, capturing more than 60% of the carbon dioxide from hydrogen production is costly and has yet to be proven at scale.

A spotlight on life-cycle emissions

Hydrogen's carbon intensity isn’t just limited to its production, stated the report. With more than 40% of announced project capacity targeting exports, it is important to understand its full life-cycle emissions, including processing ammonia and transportation.

“If transport is required, production emissions for hydrogen only tell part of the story, as unaccounted, often substantial, emissions occur through the rest of the value chain. For example, any future trade in hydrogen between Australia and Northeast Asia or the Middle East and Europe requires hydrogen to be shipped across significant distances,” De La Cruz said.

Many countries have already established carbon-intensity thresholds for low-carbon hydrogen. But most, including future importers such as Japan and South Korea, only count production or well-to-gate emissions. For future developers and buyers of blue and green hydrogen, it is critical to consider emissions abatement strategies across each step of the value chain.

Most developers of hydrogen export projects aim to use ammonia as the carrier. While it is the most promising carrier from a cost and a technology readiness perspective, ammonia’s total value chain emissions, including synthesis, transportation, and cracking, are significant, and could add 1-4.5 kgCO2e/kgH2 to the carbon intensity of the final product.

Complying with regulatory requirements

Emissions from transport and processing can make a critical difference to whether hydrogen sources can meet regulatory requirements, stated the report. Green hydrogen with 20% grid supply and blue hydrogen with 60% capture do not make the cut in the EU or Japan. But even US blue hydrogen, with 95% capture converted to ammonia and shipped to the EU, would be at the very limit of the European carbon intensity threshold. Cracking the ammonia back into hydrogen in the Netherlands, for example, would tip hydrogen over the edge.

Green hydrogen made using 100% renewable power and converted into green ammonia would have an emissions intensity below the EU threshold, even if shipped from Australia. But if imported hydrogen is produced using even a small amount of grid power, it could struggle to stay below EU and Japanese threshold limits. Exporters will need to focus on technologies for reducing the emissions from ammonia, transportation, and processing, so they can comply with varying regulation.

De La Cruz added: “Subsidies will be vital to support low-carbon hydrogen supply and demand for years to come and will make or break project economics. With carbon intensity thresholds and associated rules forming the basis of incentive frameworks in most markets, a key issue for the industry now is how far these rules will incorporate full-cycle emissions.”

Only the EU defines carbon intensity as including emissions across the full life cycle through its Delegated Acts. In the US, guidance issued by the Treasury in December 2023 sets increasingly demanding requirements for projects to be eligible for the maximum US$3/kgH2 production tax credit available under the Inflation Reduction Act. However, under the current well-to-gate scope, US green hydrogen project developers need to source renewable electricity only for their production, not for any conversion to ammonia or another derivative.

In Asia, Japan and South Korea have signalled they will gradually expand the emissions scope to ‘landed’ to include ammonia conversion and transportation emissions, though neither has yet implemented this.

ENDS

Editor’s Notes

About the report:

Over the rainbow: Why understanding full value–chain carbon intensity is trumping the colour of hydrogen

In this month’s Horizons report, Wood Mackenzie looks at the significant variance across 'green' hydrogen depending on the source of electricity, analyse where and how carbon emissions are added through the processing, conversion to ammonia and transportation. Wood Mackenzie considers the rapidly emerging rules and regulations that will define what 'green' really means and look at the evolving subsidy environment linked to these rules.

For a copy of the report, please contact: Vivien.lebbon@woodmac.com

The global hydrogen market today is around 90 Mtpa almost all of it carbon-intensive grey or brown hydrogen. Looking ahead project production is forecasted to triple to 270 Mtpa by 2050, with low-carbon green and blue hydrogen accounting for 200 Mtpa of this, according to Wood Mackenzie’s base case as outlined in the Energy Transition Outlook.

*Brown hydrogen definition

Brown hydrogen is made from coal or lignite via the gasification process.

See image attached - Blue and green emissions, 2023. Assumptions:

Blue hydrogen: Assuming a retrofitted SMR unit with 60% capture. Reforming emissions will vary by technology (SMR vs ATR) and whether the asset is retrofit or newbuild. For upstream, we assume the average emissions for all gas-producing assets in each country, including methane fugitive emissions. Upstream emissions and methane fugitive emissions vary by asset. Electricity for reforming and CCS is sourced from the grid, assuming an average grid intensity in each country. The grid intensity will vary by region in larger markets such as Australia and the US and will decrease over time.

Green hydrogen: assuming an average grid intensity in each market. Electricity consumption assumed is 55kWh/kgH2 for the electrolyser system. The electricity consumption will vary by electrolyser technology and can range from 40 kWh/kgH2 to 60 kWh/kgH2 for an electrolyser system. Electrolyser efficiency is expected to improve over time.

Recent news

Lens Hydrogen & Ammonia

Lens Hydrogen and Ammonia provides detailed analytics data and combined workflows across the integrated natural resources value chain providing businesses with decision intelligence like never before. Lens Hydrogen enables businesses to examine market fundamentals and evaluate project economics across a complex value chain, from production to storage, transport, and distribution, through to end use sectors.

For more information, visit Lens Hydrogen and Ammonia.

For further information please contact Wood Mackenzie’s media relations team:

Europe

Vivien Lebbon, T: +44 330 174 7486, E: Vivien.lebbon@woodmac.com

The Big Partnership (UK PR agency). E: woodmac@bigpartnership.co.uk

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That’s why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years’ experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers’ decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com.

- 导演乔梁电影《追月》上映,讲述台前台后的反差人生

- 3月征期定了! 截止15日!

- LambdaTest Announces algoQA Integration for Enhanced Testing Efficiency

- 白山方大集团召开315消费者权益日暨“白山方大诚信日”庆祝大会

- 老板电器登陆2024 AWE,油烟治理三大创新助力美丽中国建设

- Brian Krzanich Joins SES AI Board of Directors

- 周子玄:新人小花深耕演技,穿搭时尚品味出众

- 2024中央空调全新选择:海信中央空调5G+荣耀家主动式守护“真香”!

- instagram协议群发助手/ig自动采集工具-ins自动推广引流新工具

- 陈数《江河之上》饰大学教授 专业气场获观众赞叹

- 电线电缆厂家:单芯BVR电线与RVV电线的柔软度比较4

- 税务优化选深圳群享科技集团安全与可视的完美结合

- 高压萃取机LC1008植源灵萃龙年送健康家庭智能

- 积家全球代言人兰尼·克拉维茨佩戴积家Reverso翻转系列计时腕表亮相2024年奥斯卡晚宴

- 川渝风唱作人史宇翔献唱四川卫视农民工春晚主题曲

- 国内拥有“智慧停车管理系统”专利最多的企业是艾润停车王

- Health technology leader Philips recognized as Clarivate Top 100 Global Innovator

- 茅台酒水行业发展电商 中国优质域名正在转让中 欢迎咨询洽谈

- Medidata 与赛诺菲疫苗扩大合作,践行以患者为中心并提升试验效率

- DATALOGIC 和 DATASENSING 将亮相2024广州国际工业自动化技术及装备展览会

- instagram群发营销软件平台,ins一键自动私信软件

- C.K. McWhorter Endows Porsche With Prestigious McWhorter Family Trust Warrant, Elevating its Current

- Acronis End-of-Year Cyberthreats Report Uncovers 222% Surge in Email Attacks During 2023

- 烂漫几多时 恰是踏青日 携手吉利星际城间客车赏花出行!

- 锦勇,辐射防护服|手套,眼镜,围裙,大褂,帽子,护臂,鞋套

- 让闺蜜先老 我要滤镜之谜的FILTERS滤镜之谜面膜究竟有何魅力

- 星地孪生与洲际航天达成战略合作,共建阿布扎比航天生态城

- 吉林省音乐家协会召开2024年全省工作会议

- 2024年西安人的“买房首选”,为何一定是招商蛇口?

- “大坚果专家”疆果果——怎一个“大”字了得!

推荐

-

海南大学生返校机票贵 有什么好的解决办法吗?

近日,有网友在“人民网领导留言板&rdqu

资讯

海南大学生返校机票贵 有什么好的解决办法吗?

近日,有网友在“人民网领导留言板&rdqu

资讯

-

私域反哺公域一周带火一家店!

三四线城市奶茶品牌茶尖尖两年时间做到GMV

资讯

私域反哺公域一周带火一家店!

三四线城市奶茶品牌茶尖尖两年时间做到GMV

资讯

-

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

-

中国减排方案比西方更有优势

如今,人为造成的全球变暖是每个人都关注的问

资讯

中国减排方案比西方更有优势

如今,人为造成的全球变暖是每个人都关注的问

资讯

-

产业数字化 为何需要一朵实体云?

改革开放前,国内供应链主要依靠指标拉动,其逻

资讯

产业数字化 为何需要一朵实体云?

改革开放前,国内供应链主要依靠指标拉动,其逻

资讯

-

一个“江浙沪人家的孩子已经不卷学习了”的新闻引发议论纷纷

星标★

来源:桌子的生活观(ID:zzdshg)

没

资讯

一个“江浙沪人家的孩子已经不卷学习了”的新闻引发议论纷纷

星标★

来源:桌子的生活观(ID:zzdshg)

没

资讯

-

看新东方创始人俞敏洪如何回应董宇辉新号分流的?

(来源:中国证券报)

东方甄选净利润大幅下滑

资讯

看新东方创始人俞敏洪如何回应董宇辉新号分流的?

(来源:中国证券报)

东方甄选净利润大幅下滑

资讯

-

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯

-

新增供热能力3200万平方米 新疆最大热电联产项目开工

昨天(26日),新疆最大的热电联产项目—&md

资讯

新增供热能力3200万平方米 新疆最大热电联产项目开工

昨天(26日),新疆最大的热电联产项目—&md

资讯

-

王自如被强制执行3383万

据中国执行信息公开网消息,近期,王自如新增一

资讯

王自如被强制执行3383万

据中国执行信息公开网消息,近期,王自如新增一

资讯