High-impact oil and gas exploration could cut global scope 1 and 2 emissions by 6% in 2030

Without creating new demand, new discoveries can help curb emissions, drive value for the industry

LONDON and HOUSTON and SINGAPORE, Nov. 21, 2024 (GLOBE NEWSWIRE) -- Investment in oil and gas exploration has plummeted two-thirds in the last decade, but the industry still has a critical role to play in decarbonisation efforts and providing advantaged barrels in the energy transition, according to the latest Horizons report from Wood Mackenzie.

According to the report, “No country for old fields: Why high-impact oil and gas exploration is still needed” the world has plenty of current resources to meet demand, with approximately 3 trillion barrels of oil equivalent (boe) inventory. This translates to resource lives of more than 45 years for oil and over 60 years for gas.

“With so much in place, it begs the question – why is exploration still needed?” said Andrew Latham. “It’s important to point out, that newly discovered fields would not increase demand, as demand neither grows when exploration succeeds nor shrinks when it fails. What can be said is that successful exploration cuts carbon intensity, lowers the cost of oil and gas to consumers, and adds value for both resource holders and explorers. As demand is proving resilient, investment in new supply is needed to displace dirtier alternatives.”

Cutting carbon

According to the report, lowering scope 1 and 2 emissions, or those created in the extraction and refining process, is better served by finding new fields than by cleaning up old ones. New fields are cleaner, thanks to modern decarbonisation technologies and higher facilities throughput.

Wood Mackenzie’s Lens Upstream reveals that new fields about to begin production in the next few years will average scope 1 and 2 emissions intensity of 17 kgCO2e/boe over 2025-30. That compares with existing supply from mature fields averaging 28 kgCO2e/boe.

“Potential gains are not trivial,” said Latham. “Exploration through the current decade is on track to provide 12% of global oil and gas supply. If we assume that these new fields displace existing supply options with emissions intensity typical of older fields, then global scope 1 and 2 emissions in 2030 would be cut by around 6%, or 100 Mtpa CO2e.”

High-value performance

Economics has also driven activity. The industry’s exploration performance has been attractive since upstream costs reset a decade ago.

“Exploration has been the most economic means of rejuvenating a portfolio with new fields, particularly for companies that seek advantaged resources, or those that are low carbon and high value,” said Latham. “Such prized assets are difficult to buy at a good price; it’s much better to discover them.”

According to the report, full-cycle returns have been consistently in double digits every year since 2015, averaging 15%. New field discoveries are valued at much more than they cost to find, with net value creation of over US$160 billion since 2015, assuming an industry planning price of US$65/bbl Brent long term (almost double the current market value of supermajor BP).

Over the past five years, Wood Mackenzie calculates industry-average breakeven prices for exploration at around US$45 per boe (Brent, NPV10%) versus US$65 per boe for M&A. The gap for advantaged resources is even wider because of the shortage of such assets on the market.

Frontier and deepwater exploration most effective

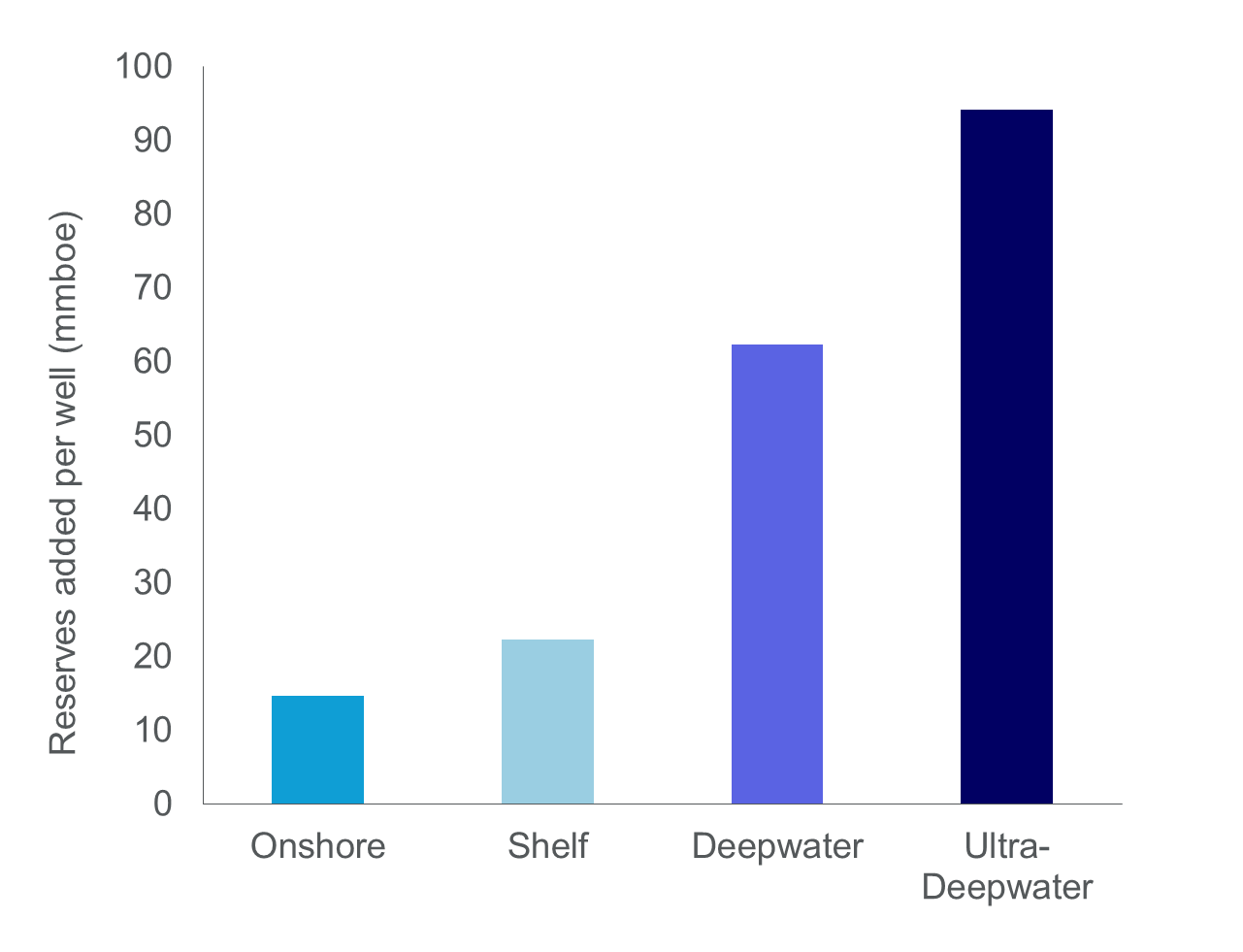

Frontier plays, defined as having no production from similar reservoirs in the same basin, stand out by resource scale. Even more so, deepwater exploration in frontier basins can offer the most effective plays. Frontier drilling added over 80 million boe per well, more than seven times wells in mature plays, with most in the deep offshore. Deepwater projects enjoy high recovery per well and tend to have lower emissions intensity (<15tCO2e/kboe) than shelf and onshore projects.

According to the report, deepwater will offer most new opportunities for exploration as most of the world’s deepwater basins, in waters from 400 metres to over 3,000 metres, are barely drilled.

Resources per exploration well by water depth

“The Majors have jumped on the bandwagon of deepwater exploration, eager to unlock the next frontier,” said Latham. “They now hold nearly 70% of their net acreage in deepwater and dedicate a similar proportion of their exploration and appraisal spending to the sector.

“Increasingly, national oil companies are following suit, as government mandates to increase production and ensure domestic energy security prevail.”

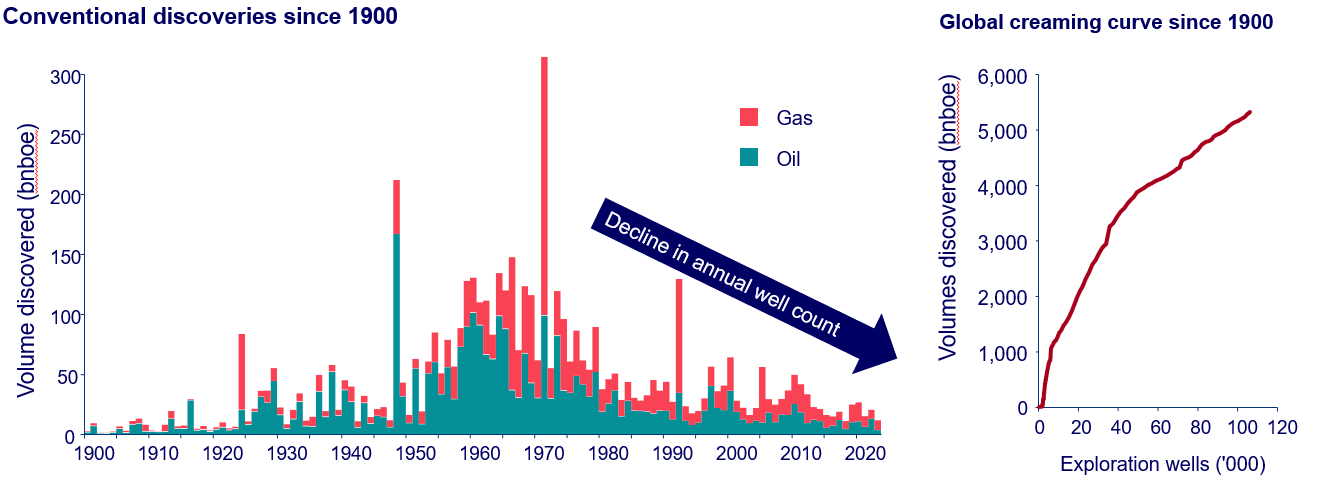

Within these untapped resources, there is still plenty of oil and gas to find. While the industry has been finding less in recent years compared with previous decades, that is down to drilling fewer wells.

The global creaming curve reveals a near straight-line trajectory with a steady gradient of around 30 million boe discovered per well, including the dry holes. It is a trend unchanged over the past four decades and more than 50,000 wells. An abrupt decline in such a long-established trend seems unlikely.

“Huge exploration opportunities still exist, but exploration does suffer from a serious image problem,” said Latham. “The widespread perception that exploration is bad for the climate threatens everything from access to opportunity and the social licence to operate to talent attraction and retention. That misconceptions abound in this regard does not mean they will be easily overcome. Exploration has a role to play in decarbonising oil and gas supply.”

For further information please contact Wood Mackenzie’s media relations team:

Mark Thomton

+1 630 881 6885

Mark.thomton@woodmac.com

Hla Myat Mon

+65 8533 8860

hla.myatmon@woodmac.com

The Big Partnership (UK PR agency)

woodmac@bigpartnership.co.uk

You have received this news release from Wood Mackenzie because of the details we hold about you. If the information we have is incorrect you can either provide your updated preferences by contacting our media relations team. If you do not wish to receive this type of email in the future, please reply with 'unsubscribe' in the subject header.

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That’s why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years’ experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers’ decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com.

Images accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/1d7064c0-062c-45f3-90d0-3ba1d994fa69

https://www.globenewswire.com/NewsRoom/AttachmentNg/759be251-f538-4398-a340-74dacfdfa04e

- 中国乳业下一个千亿级风口,羊奶品牌羊大师正在加速破圈

- 科赴中国携手各方提升全民健康素养,支持健康中国建设

- TATA木门携手世乒赛打造体育盛宴,展现中国品牌风采

- 执行可持续发展战略后HDBank录得8165万亿越南盾盈利,不良贷款率仅1.59%

- 顺丰冷运与万纬再度合作云仓项目 青岛总仓正式开仓

- ExaGrid分层备份存储被第五届年度数据突破奖励计划(Annual Data Breakthrough Awards Program)评为“年度最佳数据备份解决方案”

- 中信银行渭南分行助力区域经济高质发展

- AG选手的护眼秘密大公开,精准营养专家优思益引关注

- Wayne Flex韦恩鹿皮鞋携手澳洲代理商,共同开拓舒适鞋履市场

- Takeda to Present Additional Clinical Trial Study Data Highlighting the Impact of Orexin Agonist TAK

- 第三届全国军地人才科技创新大会 全球科学植物性饮食产业峰会紧张筹备中

- 缅甸吴廷森林寺院恭迎108座佛陀与佛陀弟子舍利子的华琪舍利子博物馆华琪舍利塔

- 杭州仁裕干冰厂冷链干冰医疗干冰烟雾干冰

- 聚焦乡村e镇区域公共品牌推介暨名优特产品鉴会,感受品牌魅力

- 著名易学风水大师敖弟良——用磁场能量解读人生奥秘

- 越捷航空再次荣膺世界旅游大奖盛典双奖

- SBTi批准近期减排目标,莱卡公司脱碳计划取得重大进展

- 肯德基食物驿站将节约粮食与爱心公益巧妙融合

- SLB推出AI驱动的Lumi平台

- 重生之陈欣予回到夏朝当红颜祸水 还原亡国妖姬妺喜

- 屡创热销奇迹,招商揽阅如何成为西安“吸睛点”?

- Tealium unveils CDP integration with Snowflake's Snowpipe Streaming API

- 万安迪筑牢易燃易爆化学品安全防线,守护每一方平安

- 方舟生存飞升开发包工具更新,激发用户创意的全新机遇

- 新希望金融科技与华为云签署AI全面合作协议,携手迈向智能时代

- C.K. McWhorter Announces Next Steps Into Sustainable Luxury and Global Philanthropic Impact

- 新书揭示全球品牌首次使用神经科学驱动的生成式AI工具赢得消费者

- 乘风而上 湖南广电重磅打造新一代短视频平台 ——风芒app焕新上线,主打微剧微综微新闻

- 【A+LIFE嫒迦生活】—矢志于打造时尚妈咪的首选,成就高端母婴生态圈。

- Boehringer Ingelheim reports strong growth in 2023 and accelerates late-stage pipeline

推荐

-

海南大学生返校机票贵 有什么好的解决办法吗?

近日,有网友在“人民网领导留言板&rdqu

资讯

海南大学生返校机票贵 有什么好的解决办法吗?

近日,有网友在“人民网领导留言板&rdqu

资讯

-

产业数字化 为何需要一朵实体云?

改革开放前,国内供应链主要依靠指标拉动,其逻

资讯

产业数字化 为何需要一朵实体云?

改革开放前,国内供应链主要依靠指标拉动,其逻

资讯

-

王自如被强制执行3383万

据中国执行信息公开网消息,近期,王自如新增一

资讯

王自如被强制执行3383万

据中国执行信息公开网消息,近期,王自如新增一

资讯

-

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

-

看新东方创始人俞敏洪如何回应董宇辉新号分流的?

(来源:中国证券报)

东方甄选净利润大幅下滑

资讯

看新东方创始人俞敏洪如何回应董宇辉新号分流的?

(来源:中国证券报)

东方甄选净利润大幅下滑

资讯

-

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯

-

中国减排方案比西方更有优势

如今,人为造成的全球变暖是每个人都关注的问

资讯

中国减排方案比西方更有优势

如今,人为造成的全球变暖是每个人都关注的问

资讯

-

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

-

中央气象台连发四则气象灾害预警

暴雪橙色预警+冰冻橙色预警+大雾黄色预警+

资讯

中央气象台连发四则气象灾害预警

暴雪橙色预警+冰冻橙色预警+大雾黄色预警+

资讯

-

透过数据看城乡居民医保“含金量” 缴费标准是否合理?

记者从国家医保局了解到,近期,全国大部分地区

资讯

透过数据看城乡居民医保“含金量” 缴费标准是否合理?

记者从国家医保局了解到,近期,全国大部分地区

资讯