A delayed energy transition could make or break the upstream sector

Prices would rise, capital discipline evolve and spending increase by 30% for the upstream sector to meet demand in a delayed energy transition scenario

LONDON/HOUSTON/SINGAPORE, 16 January 2025 – As the risk of a delayed energy transition scenario increases, so does the possibility of a much greater pull on future oil & gas supply. But meeting this demand would require a significant increase in upstream investment, resulting in higher hydrocarbon prices and significant shifts in corporate strategy, according to the latest Horizons report from Wood Mackenzie.

According to the report “Taking the strain: how upstream could meet the demands of a delayed energy transition”, a variety of external pressures have weakened government and corporate resolve to spend the estimated US$3.5 trillion required to restructure energy systems to limit both hydrocarbon demand and global warming.

Wood Mackenzie’s latest Horizons report focuses on the additional resources and spend required if the upstream sector was to meet higher-for-longer oil and gas demand, and the resultant consequences.

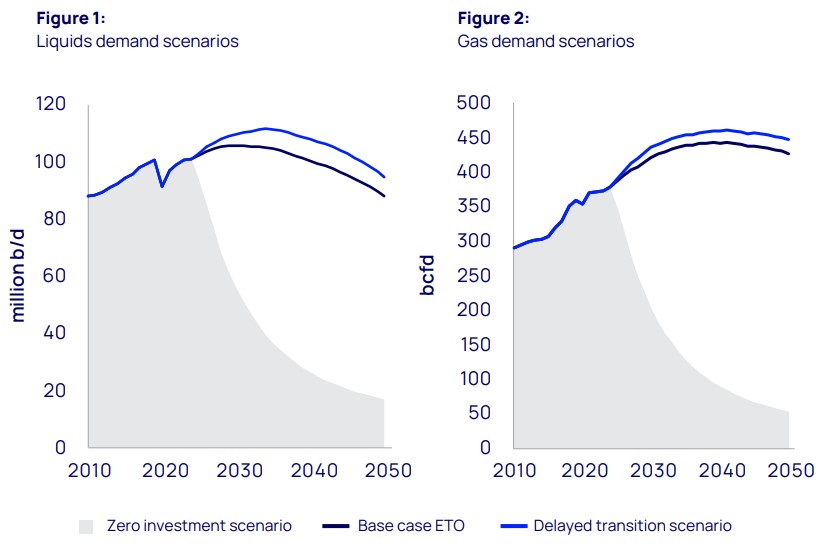

Under this scenario the world would require 5% more oil and gas supply and 30% higher annual upstream capital investment. Liquids demand would average 6 million b/d (6%) higher than Wood Mackenzie’s base case to 2050, and gas demand would average 15 bcfd (3%) higher than the base case.

“Meeting rising demand in the near term in either the delayed scenario or the base case poses little challenge to the sector; plenty of supply is available,” said Fraser McKay, head of upstream analysis for Wood Mackenzie.

“However, stronger-for-longer demand growth is a much stiffer ask. A five-year transition delay would require incremental volumes equivalent to a new US Permian basin for oil and a Haynesville Shale or Australia for gas,” said Angus Rodger, head of upstream analysis for Asia-Pacific and the Middle-East.

Source: Wood Mackenzie Energy Market Service – Global Energy Transition Outlook

Increased upstream investment needed

While we believe the global oil and gas sector could meet this demand through existing resources and future exploration, significant investment would be required to achieve it.

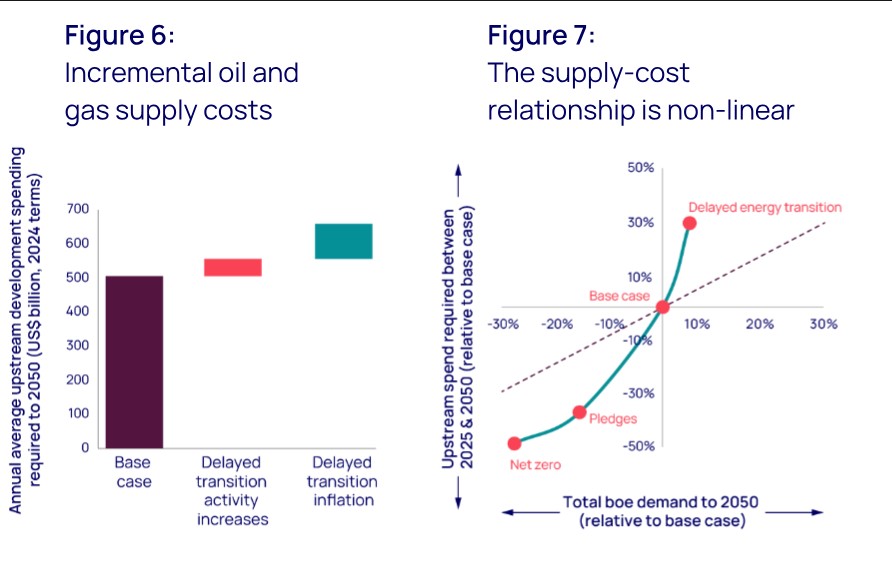

Wood Mackenzie estimates that upstream spending would have to rise by 30%, resulting in US$659 billion of annual development spend versus US$507 billion in the base case, and US$17 trillion versus US$13 trillion in total to 2050 (all in 2024 terms).

“We have calculated the sector’s cost elasticity by integrating our field-by-field annual supply models with our global supply-chain analysis,” said McKay. “This includes an assumption for continued operational efficiency improvements, which the industry could very well outperform, mitigating some of the inflationary impact.”

But increasing spend won’t be easy, even if the signs of increased demand are present. More activity would put significant pressure on the supply chain – parts of which are already running near capacity – and project costs would inflate.

“The industry’s current strict capital discipline edict would also have to change or, at least, what defines discipline would have to evolve,” said Rodger.

“Corporate planning prices would increase if the outlook for the market improved, with increased confidence in demand longevity. In that environment, higher development unit costs and breakevens would likely be tolerable,” said McKay.

Price escalation

With the higher cost of supply, so too would come higher prices for both oil and gas. Wood Mackenzie’s Oil Supply Model forecasts a Brent price rising to over US$100/bbl during the 2030s in a delayed transition scenario. It falls towards US$90/bbl by 2050, averaging around US$20/bbl higher than our base case over the period (all in 2024 terms).

Read the entire report here.

ENDS

Editors Notes:

Definition of scenarios:

Base case - Wood Mackenzie’s base case is an assessment of the most likely outcome, corresponding to 2.5 ˚C warming by 2050, incorporating the evolution of current policies and technology advancement.

Delayed transition scenario - Assumes a five-year delay to global decarbonisation efforts due to ongoing geopolitical barriers, reduced policy support for new technologies and cost headwinds.

For further information please contact Wood Mackenzie’s media relations team:

Mark Thomton

+1 630 881 6885

Mark.thomton@woodmac.com

Hla Myat Mon

+65 8533 8860

hla.myatmon@woodmac.com

The Big Partnership (UK PR agency)

woodmac@bigpartnership.co.uk

You have received this news release from Wood Mackenzie because of the details we hold about you. If the information we have is incorrect you can either provide your updated preferences by contacting our media relations team. If you do not wish to receive this type of email in the future, please reply with 'unsubscribe' in the subject header.

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That’s why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years’ experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers’ decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com.

Source: Wood Mackenzie Energy Market Service – Global Energy Transition Outlook

Increased upstream investment needed

While we believe the global oil and gas sector could meet this demand through existing resources and future exploration, significant investment would be required to achieve it.

Wood Mackenzie estimates that upstream spending would have to rise by 30%, resulting in US$659 billion of annual development spend versus US$507 billion in the base case, and US$17 trillion versus US$13 trillion in total to 2050 (all in 2024 terms).

“We have calculated the sector’s cost elasticity by integrating our field-by-field annual supply models with our global supply-chain analysis,” said McKay. “This includes an assumption for continued operational efficiency improvements, which the industry could very well outperform, mitigating some of the inflationary impact.”

But increasing spend won’t be easy, even if the signs of increased demand are present. More activity would put significant pressure on the supply chain – parts of which are already running near capacity – and project costs would inflate.

“The industry’s current strict capital discipline edict would also have to change or, at least, what defines discipline would have to evolve,” said Rodger.

“Corporate planning prices would increase if the outlook for the market improved, with increased confidence in demand longevity. In that environment, higher development unit costs and breakevens would likely be tolerable,” said McKay.

Price escalation

With the higher cost of supply, so too would come higher prices for both oil and gas. Wood Mackenzie’s Oil Supply Model forecasts a Brent price rising to over US$100/bbl during the 2030s in a delayed transition scenario. It falls towards US$90/bbl by 2050, averaging around US$20/bbl higher than our base case over the period (all in 2024 terms).

Read the entire report here.

ENDS

Editors Notes:

Definition of scenarios:

Base case - Wood Mackenzie’s base case is an assessment of the most likely outcome, corresponding to 2.5 ˚C warming by 2050, incorporating the evolution of current policies and technology advancement.

Delayed transition scenario - Assumes a five-year delay to global decarbonisation efforts due to ongoing geopolitical barriers, reduced policy support for new technologies and cost headwinds.

For further information please contact Wood Mackenzie’s media relations team:

Mark Thomton

+1 630 881 6885

Mark.thomton@woodmac.com

Hla Myat Mon

+65 8533 8860

hla.myatmon@woodmac.com

The Big Partnership (UK PR agency)

woodmac@bigpartnership.co.uk

You have received this news release from Wood Mackenzie because of the details we hold about you. If the information we have is incorrect you can either provide your updated preferences by contacting our media relations team. If you do not wish to receive this type of email in the future, please reply with 'unsubscribe' in the subject header.

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That’s why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years’ experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers’ decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com.

- FPT Software Partners with Siemens to Provide Low-code Platform Mendix in Korean and Japanese Market

- 欧洲分销给BC小众市场的机会都不给了?

- IIBA Launches New Chapter Platform Supporting Global Community Engagement

- World Science Forum 2024 Declaration Calls for Strengthening Trust in Science Globally

- LG Chem为阻燃塑料增添环保特性

- 中信银行太原分行以优质服务解客户燃眉之急

- WhatsApp(六段频道号),WS(六段协议号)大量出售

- 橡树岭国家实验室将IQM Resonance量子云服务添加到其量子计算用户计划中

- 澳门银河 莱佛士奢华盛典隆重举行 开启卓越品质服务崭新篇章

- AMPLE SOLUTIONS 集团2024敦煌年会落幕:大漠戈壁,安芯易行

- 农发行晋中市分行党委理论学习中心组召开专题学习研讨(扩大)会

- 2ONE Labs and Performance Plus Marketing, sellers of 2ONE Nicotine Pouches, Allege Fraud and Seek Da

- 国内企业员工换工作意向下降,大多持观望保守心态

- 洲际酒店集团年末盛宴启幕 多元化消费场景让“每一刻‘聚’精彩”

- Minovia Therapeutics Announces FDA Clearance of IND Application for a Phase Ib Clinical Trial of MNV

- 2024莱州徒步大会暨第二届半程马拉松九月燃情启幕,共绘莱州盛景

- Kioxia开发出OCTRAM(氧化物半导体通道晶体管DRAM)技术

- PCI Pharma Services位于新罕布什尔州贝德福德的园区顺利通过国际药品监管机构联盟的检查

- “健康广东 民生幸福”免费肿瘤早筛与治疗援助工程温暖启动 开启民众健康新篇章

- 品牌价值突破200亿元,徐福记再次荣登“中国500最具价值品牌”榜单

推荐

-

抖音直播“新红人”进攻本地生活领域

不难看出,抖音本地生活正借由直播向本地生活

资讯

抖音直播“新红人”进攻本地生活领域

不难看出,抖音本地生活正借由直播向本地生活

资讯

-

透过数据看城乡居民医保“含金量” 缴费标准是否合理?

记者从国家医保局了解到,近期,全国大部分地区

资讯

透过数据看城乡居民医保“含金量” 缴费标准是否合理?

记者从国家医保局了解到,近期,全国大部分地区

资讯

-

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

-

王自如被强制执行3383万

据中国执行信息公开网消息,近期,王自如新增一

资讯

王自如被强制执行3383万

据中国执行信息公开网消息,近期,王自如新增一

资讯

-

周星驰新片《少林女足》在台湾省举办海选,吸引了不少素人和足球爱好者前来参加

周星驰新片《少林女足》在台湾省举办海选,吸

资讯

周星驰新片《少林女足》在台湾省举办海选,吸引了不少素人和足球爱好者前来参加

周星驰新片《少林女足》在台湾省举办海选,吸

资讯

-

产业数字化 为何需要一朵实体云?

改革开放前,国内供应链主要依靠指标拉动,其逻

资讯

产业数字化 为何需要一朵实体云?

改革开放前,国内供应链主要依靠指标拉动,其逻

资讯

-

一个“江浙沪人家的孩子已经不卷学习了”的新闻引发议论纷纷

星标★

来源:桌子的生活观(ID:zzdshg)

没

资讯

一个“江浙沪人家的孩子已经不卷学习了”的新闻引发议论纷纷

星标★

来源:桌子的生活观(ID:zzdshg)

没

资讯

-

男子“机闹”后航班取消,同机旅客准备集体起诉

1月4日,一男子大闹飞机致航班取消的新闻登上

资讯

男子“机闹”后航班取消,同机旅客准备集体起诉

1月4日,一男子大闹飞机致航班取消的新闻登上

资讯

-

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

-

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯